Supplier Payments Never Felt Better

Restaurant owners are particularly aware of the challenge of handling multiple suppliers. While managing the logistics is already a challenge; collecting, validating and paying invoices represent another significant time-consuming effort.

How do accounts payable impact restaurants’ activity?

Hours and hours—ten on average—are spent per week collecting and entering invoices manually. Not only is this a significant time investment, but it also leads to mismanagement of spending and unpaid invoices.

Unpaid invoices can damage a business’s reputation, not to mention its long-term viability. It is also a fact that a quarter of bankruptcies are due to late incoming and outgoing payments.

Undoubtedly, the industry has been silently waiting for a solution to dramatically decrease the time spent on accounts payable—less time for invoices, more time to create your menus.

A better future for paying suppliers?

Digital companies provide innovative solutions that help restaurants with booking, delivery management, brand awareness, and more.

You need help handling accounts payable? This is where Libeo comes in: a solution for SMB’s to centralise and pay their invoices, all in one click, without connecting to their banking interface.

It is a simple, straightforward web application with a mobile app that allows small businesses to collect, validate and pay invoices.

Libeo offers multiple benefits, among them them the abilities to:

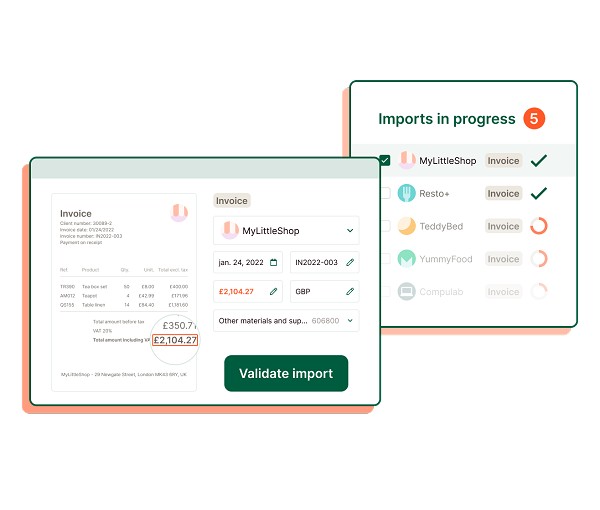

- Import invoices and automatically extract key information: due date, amounts, the identity of the supplier, etc.

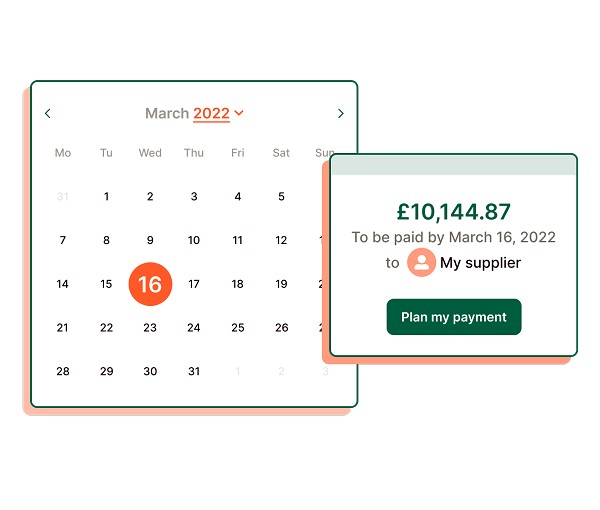

- Plan your payments: schedule the payment date, pay in full or schedule a payment sequence at specific dates and amounts to be automatically executed.

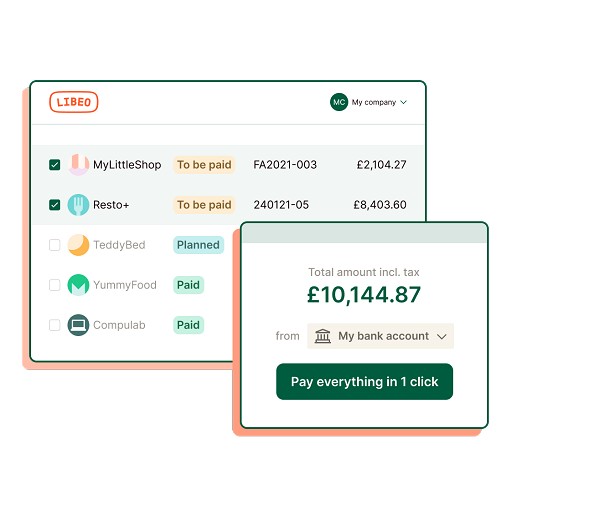

- Pay in one click without logging in to your bank account.

One of the reasons Libeo is hugely time-saving is that it enables bulk handling of invoices.

Import large batches of invoices at once. The software will automatically detect duplicates and allow you to review these cases.

Then, you can quickly set up bulk payments with different due dates, all in the same interface.

Additional perks of the platform’s digitisation of supplier invoices include real-time financial monitoring, a complete history of sent and received payments, and free access for your chartered accountant.

It also integrates easily into existing tools like Xero, Quickbooks, Sage and most UK banking interfaces. You’ll get better spend control with transparent, extractable financials. No more manual data entry is needed and you won’t see any more more errors related to manual data entry.

Since its founding, Libeo has raised £22M in capital, and nearly 100,000 small businesses have come aboard to centralise and pay their supplier invoices. Overall, Libeo bridges the gap between invoicing, payment, reconciliation, and accounting.

Case study: How a 2 location family restaurant handles payments

A small family restaurant with two locations serving 4,000 meals a week using fresh, local ingredients equals multiple suppliers to manage. Their review?

“We’ve divided by three the time spent on supplier invoices for collection, payment, and analysis. It allows me to focus on the business – future locations, team management, cash flow, etc.”

Libeo is working to free food and drink businesses from the weighty work of managing and paying supplier invoices. If you have a small business and you’re curious to learn more about how you can simplify your daily life when paying your suppliers, get in touch with the team at https://libeo.io/en?utm_source=tae or hello@libeo.io